New Atlanta Tax Assessments

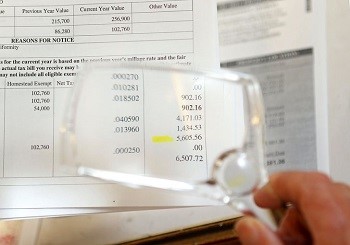

This time last year homeowners got a shock when they opened their mail and took a look at their new Atlanta tax assessments. We wrote in our blog in “Appealing Your Property Taxes; how when why you should do it:”

This time last year homeowners got a shock when they opened their mail and took a look at their new Atlanta tax assessments. We wrote in our blog in “Appealing Your Property Taxes; how when why you should do it:”

The Atlanta Journal Constitution writes that “(Property) values rose 20 percent or more in Decatur, Stone Mountain, Palmetto and other communities, the newspaper found. Cities from Dacula to Alpharetta to Jonesboro also saw double-digit increases.

It’s déjà vu. Mark Niesse and David Wickert at The Atlanta Journal-Constitution wrote this week, “Gina and Michael Schwartz got a nasty surprise when their DeKalb County tax assessment arrived in the mail recently.

According to the county assessor’s office, the value of their Brookhaven home rose 10 percent from last year to $318,300, though they’ve made no improvements and don’t think that’s what the market will bear. Now they’re worried about the property tax bill that will come this fall.

As we said last year, “If you’re interested in getting an assessment review, you really should contact your local county’s assessor or auditor office and ask what the process is for getting your property taxes lowered.”

Gather your facts. Get a list from a realtor of property sales in your area that compare to your house: the number of bedrooms and bathrooms and size of house, for example. Then you may want to hire an inspector for an appraisal. This can cost somewhere between $100 and $1,000. You have to decide if it is worth it to pay $500 to save $500 in taxes. In the case of Kathy Kirk of Brookhaven, whose tax bill would increase over $3,000, getting an appraisal for $1,000 to save $3,000 would be worth it.

This is the fourth straight year property values have jumped in the wake of the Great Recession. Residential property assessments were up 17 percent last year and 11 percent in 2014.

Counties conduct annual assessments of the value of real estate for tax purposes. Those values, along with tax rates set by local governments, are used to set property tax bills.

Property owners can appeal their assessments until July 18.

Val Buys Houses LLC is here to help homeowners out of any kind of distressed situation. As investors and realtors we are in business to make a modest profit on any deal, however we can help homeowners out of just about any situation, no matter what! There are no fees, upfront costs, commissions, or anything else. Just the simple honest truth about your home and how we can help you sell it fast to resolve any situation.

Give us a call today at 404-844-8845 to let us know what YOU need help with!